Medicare is federal health insurance for people 65 years or older and for those who are eligible due to a disability. The Social Security Administration recommends that you apply for Medicare Part’s A and B three months before you’d like your benefits to begin.

Medicare is federal health insurance for people 65 years or older and for those who are eligible due to a disability. The Social Security Administration recommends that you apply for Medicare Part’s A and B three months before you’d like your benefits to begin.

Medicare Part A is hospital insurance coverage. Medicare Part B covers outpatient services like doctor visits, lab tests, x-rays, and other services.

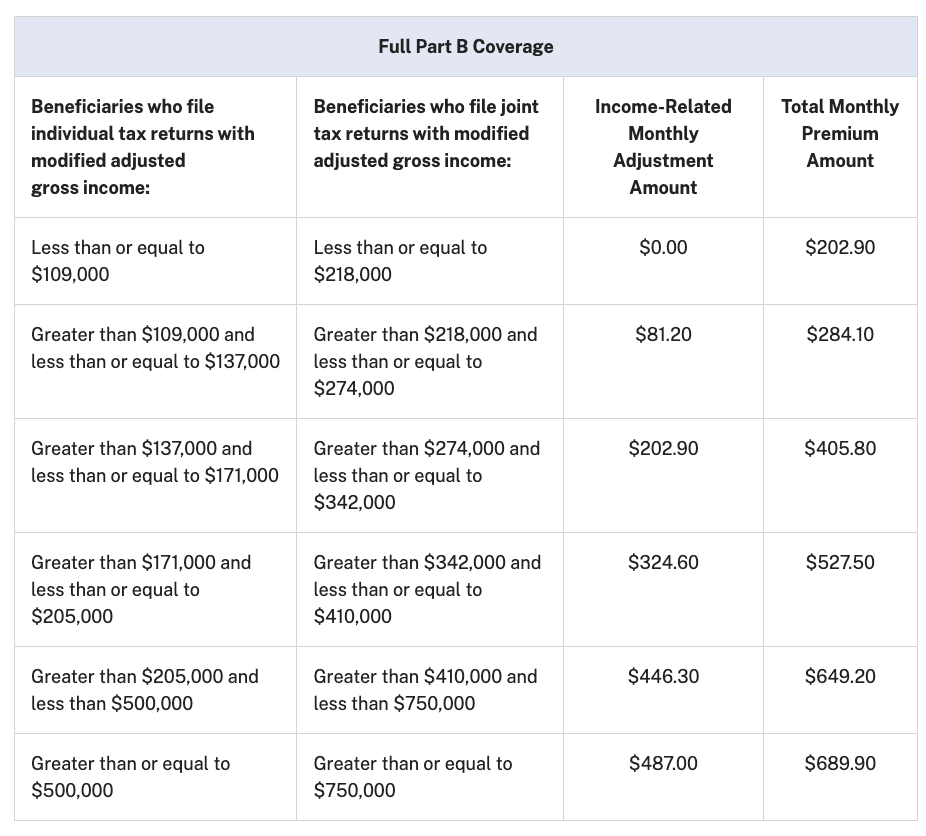

For most people Medicare Part A is free. Below is a chart showing the 2026 Medicare Part B Premiums. High income earners may also be subject to Income-Related Monthly Adjustment Amount (IRMAA) surcharges for Medicare Part’s B and Part D. Please note that the IRRMA surcharges can be appealed for a variety of reasons using form SSA-44. Possible qualifying life events include work stoppage, work reduction, loss of income producing property, loss of pension and more.

Unless you are or will be receiving Social Security Benefits, you’ll need to pay Medicare for your Part B (and any IRRMA surcharges). They will send you a quarterly invoice, but most people sign up for monthly autopay for EasyPay at the Medicare.gov website. Those payments will continue until you start receiving Social Security benefits, at which time SSA should start auto-deducting your Part B premiums from your benefits.

In 2026, the Medicare Part B deductible is $283. After you met your deductible, you are responsible for paying the remaining 20% with no cap on your out-of-pocket costs.

If you’re a Medicare beneficiary looking for coverage to fill in the gaps for Medicare Part A and Part B, you’ve come to the right place. Follow this link find a choice of Medicare supplemental or “Medigap” coverage options at competitive rates to help fill those gaps.

Please note that you can have Medicare Advantage OR a Medicare Supplement, but not both at the same time. Visit the Medicare Supplement Vs. Medicare Advantage Decision Guide.